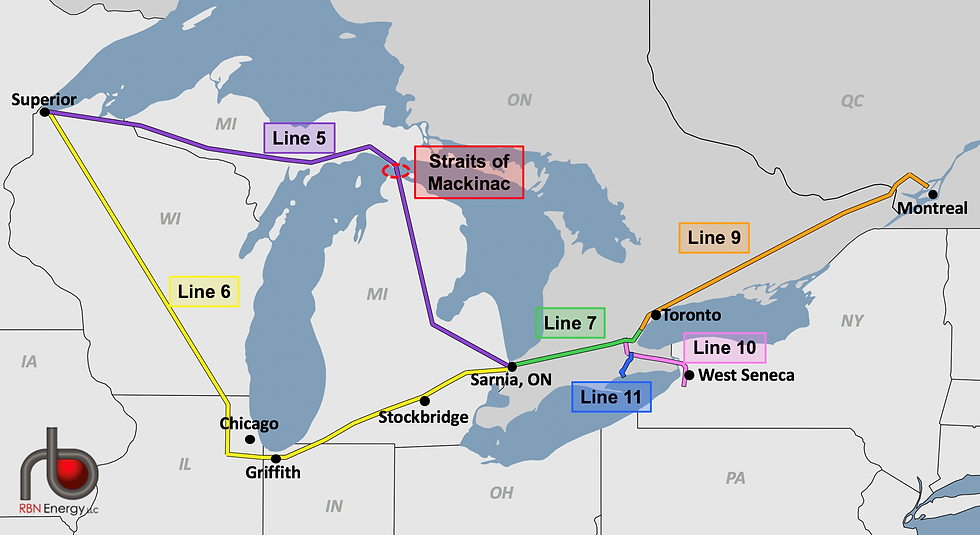

Michigan Governor Gretchen Whitmer has ordered Enbridge Pipelines to shut down Line 5, a 645 mile pipeline that is part of the system that brings western Canadian and U.S. Bakken oil to the US upper midwest and Eastern Canada refining hubs. Enbridge has vowed not to comply and is taking the governor to court to have her order revoked. The dispute centers on a specific section of pipe that is under the Straits of Mackinac, a waterway that connects Lake Michigan and Lake Huron and which is also a major shipping lane. Governor Whitmer argues that the 68 year old pipeline is at high risk of a catastrophic spill that would be devastating to the Great Lakes ecology and to the local economy. Enbridge claims its pipeline is safe but has announced a plan to encase this small section inside a concrete tunnel to protect the waterway. Enbridge also points out that the pipeline supplies much of the heating oil and gasoline that Michigan and surrounding states need, and that shutting the line down would be economically devastating to both the US and Canada. There is a lot of anger and finger-pointing here, but one thing is abundantly clear: Enbridge really has only itself to blame.

The company's track record on safety is abysmal. It has had 33 known spills in the Line 5 system since inception, totalling over one million gallons. In 2010, its Line 6B dumped 1.2 million gallons of oil into the Kalamazoo River, which also happens to be in Michigan and there is little doubt that that spill has coloured Michigan's attitude towards the company. In 1991, Enbridge's Line 3 spilled 1.7 million gallons of oil onto the Prairie River in Minnesota. I say 'onto' because luckily it happened in March, and much of the river was frozen. Nonetheless, it took Enbridge more than 10 years to fully clean up the mess it made. These are the two largest inland pipeline spills in US history. Suffice to say, this is not the way you win hearts and minds in a foreign country. But accidents should be expected when you're dealing with miles and miles of pipelines, right? Not really. The Trans Mountain Pipeline, which runs from just outside Edmonton all the way to Vancouver, has only had 3 minor incidents since 2005 and has never had a major spill in its 68 years of existence.

The easement granted by Michigan for Line 5 in 1953 holds that the pipe must be anchored every 75 feet. After the company repeatedly rebuffed efforts to verify that the supports were still sound, the government had a video taken in 2013 which revealed that large spans, one as long as 286 feet, were unsupported. Enbridge had known about this situation since at least 2003. If the pipeline isn't anchored properly, strong currents could bend the pipe over time, leading to a potential spill. Add to this that there have been at least two incidents in just the last few years of ships unwittingly damaging the pipeline and there is ample evidence that Whitmer's alarm about Line 5 is warranted.

According to one study, a spill in the Straits would be difficult to contain because the strong currents would quickly spread the oil far and wide. This study estimated potential damages could be over $6 billion (C$7.5 billion). In another instance of the company cutting corners, Enbridge has liability insurance for only $700 million for all of its international operations. What would happen if this admittedly worst-case scenario came to pass?

Over the past 26 years, Enbridge has increased its dividend at an average compound annual growth rate of ten percent. In fact, Enbridge has paid out 95 percent of its operating income in dividends over the last five years. It has done this while taking on a mountain of debt; the company now has $73 billion in debt (on a market capitalization of $98 billion) and it paid $2.75 billion in interest in 2020 alone. There are plenty of simple-minded investors out there who buy Enbridge stock solely because its dividend yields 7 percent and they don't seem too interested in looking under the hood. If they did, they'd see some warning signs that a major accident could put the company in financial jeopardy.

So we have a company with a history of bad spills skimping on maintenance and insurance, while continually taking on debt to grow its revenue and its dividend, all in the name of short-term stock price gains. Management does this because the market demands growth at almost any cost and the stock price is what determines management's compensation. Al Monaco, the CEO, has made well over $100 million since he took over in 2012. But what about later when all of this 'stuff' inevitably hits the proverbial fan? As they say on Wall Street, IBGYBG: I'll be gone, you'll be gone.

Back in 2011, when the subprime mortgage shenanigans were still fresh in everyone's mind, well-known investor Barry Ritholtz wrote a piece on what he thought could be done to prevent a repeat. Ritholtz suggested that if executives knew they could be held personally liable for reckless behavior - if regulators, shareholders and boards of directors could take back compensation - then they would most likely behave much differently. Ritholtz was writing about Wall Street and investment banks, but I think his idea can be applied to every company (*). If Al Monaco knew he could lose his $100 million because of a catastrophic spill, do you think Line 5 would be properly maintained? In fact, I'd bet that tunnel would have been built a long time ago.

There aren't going to be any winners in this. If Enbridge beats Whitmer in court, there are several First Nations tribes and environmental groups ready to challenge that ruling, meaning it will likely be mired in the courts for years. While some opponents are arguing that Line 5 isn't actually needed, this contention isn't even remotely true; the pipeline is a huge piece of the energy infrastructure that supplies the eastern part of the continent. If the pipe were to be shutdown, oil would still have to move, but it would do so by truck and rail, options that are neither economically nor environmentally logical. It didn't have to be this way, and the blame falls squarely on the short-sighted management at Enbridge.

(*) This would likely require amending the definition of a limited liability corporation.

Source: www.rbnenergy.com

Commenti